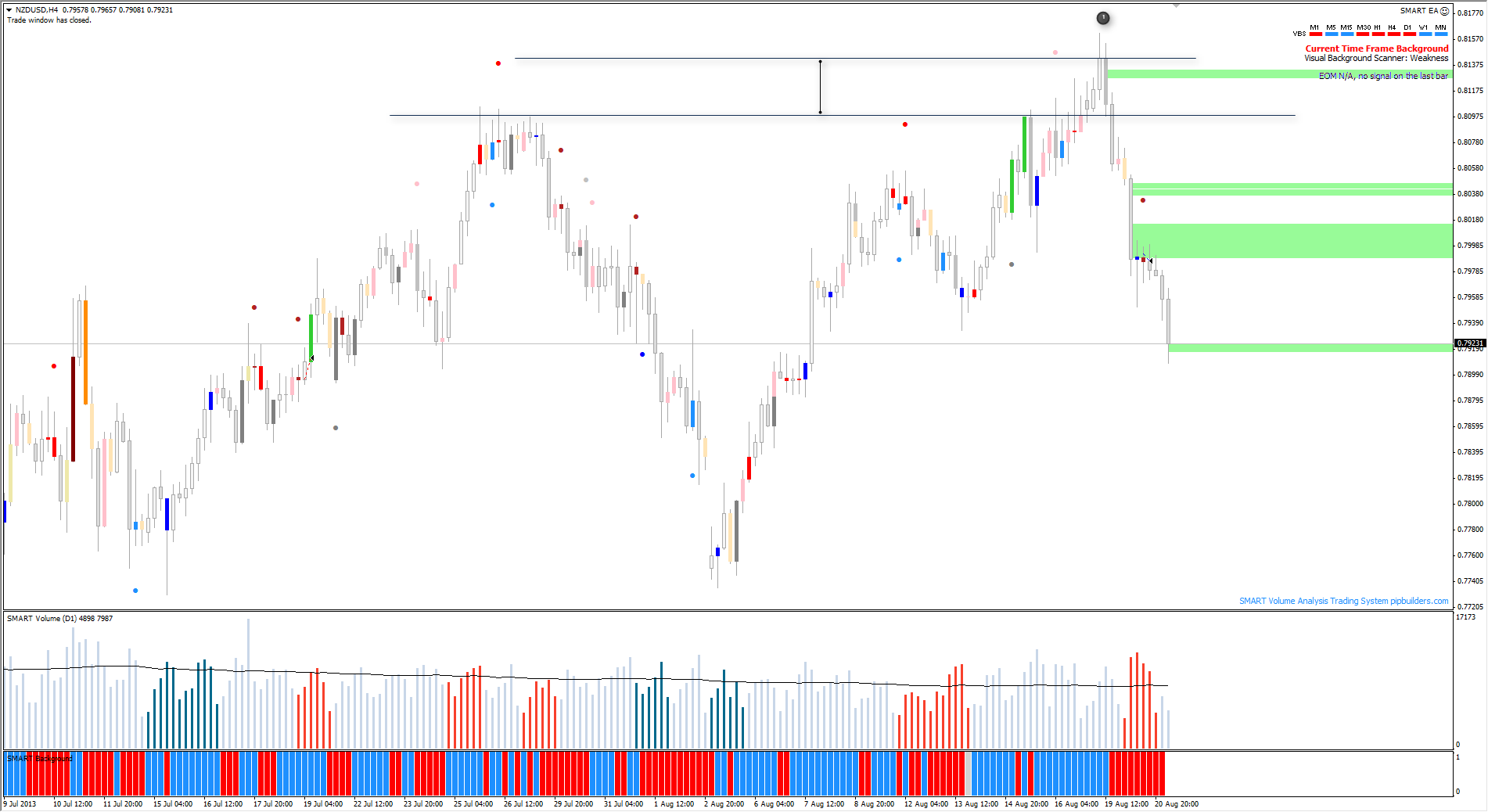

A quick chart showing some Catalyst signals (Stronger Signals That tend to precede bigger moves on longer time frames) Using EOM (Proprietary Target System) on these alone and you could pretty much retire.

As a bonus I have a test version of a future module (The Smart Visual Advisor)

There are many catalyst signals (Live Doc coming soon) this screenshot highlights just two of them. They happen to be my favorites.

1. Catalyst Signal (Smart Upthrust)

2. Catalyst Signal (Smart Reverse Upthrust) With Additional Smart Visual Advisor Blue Bar (No warnings that I filter for appear)

For more information or if you have any questions about SMART Volume Analysis (SVA) and Smart Volume Spread Analysis (VSA) the methods, or our Software (Smart Trader) please visit the following link

Usergroups:

- Smart Traders Official Google+ Community (Recommended): http://goo.gl/7X6UD

- Smart Traders Official Google+ Page: http://goo.gl/B0Eph

- Smart Traders Official Facebook Group (Closed To New Members): http://goo.gl/8vH1t

- Smart Volume Analysis Blog: http://goo.gl/wHdCU (News, Information, Trading Methods Etc.)

Miscellaneous Resources:

- Smart Volume Analysis Video Newletter: http://goo.gl/zoUDd

- Free Live Room (Usually Runs Each Day): http://goo.gl/2bKP9 (Check usergroups for start times)

Contact and Support Links:

![number-3-md[1]](http://blog.pipbuilders.com/wp-content/uploads/2013/04/number-3-md1.png)