Learn how smart volume spread analysis techniques and methods can massively accelerate success and profits, all while minimizing the risks of basket trading (trading baskets) aka group trades

Learn how smart volume spread analysis techniques and methods can massively accelerate success and profits, all while minimizing the risks of basket trading (trading baskets) aka group trades

As many of you know, I trade baskets using Smart Volume Spread Analysis and our unique trading tools with extraordinary results. Trading groups more commonly known as Basket Trading using smart volume spread analysis is one of the greatest ways to trade and it’s actually very safe contrary to what many traders may think. Read on for some common misconceptions and mistakes people make when trading baskets and why smart volume spread analysis does away with any question in terms of entries and targets etc. This article may quite literally change your life. Many clients have asked for an article detailing how I basket trade using Smart but I procrastinate quite a bit when it comes to writing. I am not the greatest writer and tend to ramble on and qualify everything for those that don’t speak English as a first language. For these reasons, if you are unclear on anything presented here or have any questions at all please send a ticket using the support link. Even if you’re not a client, I answer every ticket personally and no matter how trivial your question may seem to you, ask anyway. I am here to help. Now, let’s get to it.

What is Basket Trading? Basket Trading, or as I call it, Group Trading is taking a position on multiple pairs/instruments at the same time to capitalize on weakness or strength in the underlying base currency or instrument. For example, if you think the USD is weak, you would short the USD by opening a “basket” of trades comprising the US Dollar major pairs such as short USD/JPY long GBP/USD etc. If you’re right it only takes a very small move on the USD to do very well on group trades. Unfortunately many traders first experience with basket trading is from one of the methods posted to various Forex and trading forums. I am sure many of you that have perused any of these forums have stumbled upon various basket trading threads. One in particular that comes up a lot when I chat with clients is T101. This was (and may still be) a very popular method for trading baskets but (unlike smart volume trading) most basket trading methods are very inconsistent as many of you may already know. The problem isn’t with the underlying concept of basket trading. The profit potential from trading groups of currencies as a single trade is an eye opener. The problem was due to the tools and methods used for entries. T101 for example uses “spaghetti” indicators among others to look at the relative strength or weakness of a particular group of currencies. The time it took for the indicator to signal a trade was usually so long that you would enter the wrong way when you finally got the green light from these lagging indicators. Occasionally you would get in a good trade and make a huge amount of pips in a very short amount of time. That’s the lure of basket trading but the reality for most basket traders using a method such as T101 is a lot of losses. That is the curse of lagging indicators. The concept of trading baskets was not new to me but it was obvious to me to use the one indicator that offers real-time information about the markets like no other… Volume. There is no better or easier way to trade baskets using volume successfully than with Smart Volume Spread Analysis.

How do you know if the price is weak or strong? We show over and over how Trade choice is made easier and safer by using “Catalyst Signals” and one or both of two very simple Smart Volume Analysis trading methods (The Four Step Method and The Signal To Signal Method) I have written about each of these and their results extensively here and in the client documentation area over the years. The only difference between what we normally discuss here is that you apply these techniques to a basket rather a single trade. It’s actually very simple. There are of course many ways to trade baskets using volume but these methods will offer a greater degree of safety and profit results unsurpassed in normal trading. As you get more comfortable with Smart and Trading Baskets it just gets easier.

The pip amounts when trading baskets correctly with the right tools, methods, and concepts can be substantial as shown by my own results using Smart Volume Analysis. Along with some simple concepts, and very powerful smart volume analysis tools included with our software (see below) you can quickly master this seemingly complicated trading strategy.

A single days result. If you’d like to see more just ask:

Yes these totals (1,139 pips) are daily totals The first screenshot shows the results for a a single day and was posted automatically by MyFXBook. The next screenshot is 1800+ pips and from a few days earlier. Both trades were made using the Smart Signal To Signal Method. When I tell people I get results like this trading baskets, they think it’s not possible or that it was just luck until I show them the screenshots or they follow along with the twitter account (See Resources Below). Some would argue that this was just a lucky trade or a single example. There is no such thing as luck. Winning trades done consistently may make it seem you are lucky but if you follow the twitter feed (Link below) you can see the results are very consistent day in and day out. It’s not luck and I hate when it’s diminished as such. It’s trading smart using Smart Volume Spread Analysis. When you understand the underlying  mechanics of basket trading and that it only takes a small move on each pair in the basket to make hundreds of pips (Sometimes within minutes) you realize not only is it possible but it’s easy too. How are such high amounts of pips possible? The easiest way to explain why 1000+ pips in a day isn’t that strange is to think about multipliers. A single trade on a currency pair that yields 30 pips is a good trade of course but that same trade with an average of 30 pips per pair in a basket of trades would yield hundreds of pips in the same amount of time. A couple of profitable basket trades like the example I posted here in a week and you can take the rest of the month off. Group trading follows very closely with my goal. Making more while trading less. How though do you know, when to enter a basket and more importantly, exit? Safety and risk is a very big concern when trading baskets because the moves can be quite large but when using Smart Volume Spread Analysis to trade you are way ahead of any other basket trading method. Let me explain why volume is the best way to trade groups and baskets. Smart Volume Spread Analysis signals trades just before large trend changes as well as big moves up and down throughout the day. This is extremely important for trading baskets. If you are right about the direction the basket will work out very well and this is much easier if you use the right methods and tools. Smart Trader Smart Volume Spread Analysis Software is exactly that.

mechanics of basket trading and that it only takes a small move on each pair in the basket to make hundreds of pips (Sometimes within minutes) you realize not only is it possible but it’s easy too. How are such high amounts of pips possible? The easiest way to explain why 1000+ pips in a day isn’t that strange is to think about multipliers. A single trade on a currency pair that yields 30 pips is a good trade of course but that same trade with an average of 30 pips per pair in a basket of trades would yield hundreds of pips in the same amount of time. A couple of profitable basket trades like the example I posted here in a week and you can take the rest of the month off. Group trading follows very closely with my goal. Making more while trading less. How though do you know, when to enter a basket and more importantly, exit? Safety and risk is a very big concern when trading baskets because the moves can be quite large but when using Smart Volume Spread Analysis to trade you are way ahead of any other basket trading method. Let me explain why volume is the best way to trade groups and baskets. Smart Volume Spread Analysis signals trades just before large trend changes as well as big moves up and down throughout the day. This is extremely important for trading baskets. If you are right about the direction the basket will work out very well and this is much easier if you use the right methods and tools. Smart Trader Smart Volume Spread Analysis Software is exactly that.

Isn’t Basket Trading Risky? If done incorrectly… Yes. If done correctly you can cut the risk substantially. Using Smart Volume Analysis you have a number of very powerful benefits before even entering a trade such as knowing the direction the market is going to go short term, the EOM levels for the trade, Trade Warnings from our Smart Trade Advisor etc. One other important consideration is that the risk of the trade is spread out among a number of pairs, not a single trade that can either fail or succeed. If any one pair falls or rises due to news or similar the rest of the basket absorbs that risk and in many cases still be a great trade. For example. Let’s say you are long the EUR based off a catalyst signal. Shortly after entering there is news in Japan that causes the EURJPY to react against the trade. The other pairs in that basket would likely absorb the negative move in the EJ as the other pairs in the basket would be less affected by the news in Japan. This is better than taking a single position in the EURJPY which would result in a loss.

The results I achieve is thanks in large part to a few concepts I developed over the years as a direct result of the risks associated with trading baskets. Many of you will recognize the following terms from the chats, articles, and methods. Things like Catalyst signals. EOM (Expectation of Movement). Time based exits etc. Many of these very common methods/concepts came directly from my experience and needs using Smart Volume Analysis for basket trading.

One thing to try as you advance is alternative baskets using smart volume signals on multiple charts instead of a single base currency. You may already be doing this now without even realizing it.

We have many new features planned for future updates to Smart Trader specifically for basket trading such as index charts. volume based strength meters, chart weighting, basket EOM averaging, signal weighting and rankings for better trade choice, and much more. I use many of these concepts/methods manually already and can explain if you’d like in a chat so that you can start using them in the meantime.

Common Misconceptions When It Comes To Trading Baskets and How Smart Volume Can Help:

- More risk due to multiple positions

- Risk is actually limited and not increased when trading baskets correctly. See above.

- Wrong direction can kill account

- Smart Volume Analysis helps to always make sure you are in the right direction and “trading with the market” and not against it. Our EOM’s get you out at the ideal target.

- No usable targets

- Our Smart EOM Targets help tremendously.

Why Use Smart Volume Analysis To Trade Baskets?

- No Lagging Indicators Associated With Trade Entry and Exit Signals/Indicators

- Unique Volume Based Basket Opportunities Unavailable To Anyone Else

- Know The Likely Direction of Market with Near 100% Accuracy

- Simple and Easy to Identify Entry Signals

- Simple and Easy to Identify Exit signals

- Make very large amounts of pips very quickly with only small underlying price moves

Resources:

- The Four Step Method Documentation (Available in the client documentation website)

- The Signal To Signal Documentation (Available Soon in the client documentation website)

- Basket Trading Entry, Exit, And Management Scripts Freely Available to Smart Clients (Submit a Ticket)

- Free Consultation and tips etc available to Smart Clients (Submit a Ticket To Schedule a Chat)

- See The Complete Results of My Basket Trading (Follow @TraderelayerGRP on Twitter)

- This is the account the screenshot posted above is is unedited and posted by MyFXBook directly, not me. It’s an older account I used to test automated basket trading systems I use personally and for Advanced alerts on Traderelayer.

If you are an existing client you likely already know and use many of the concepts detailed here for your trading and can quickly use them to trade baskets. I can help if you need it, just ask. I have articles planned that will detail some easy methods in the coming weeks.

If you do not yet own Smart please check out our order page for a special offer to get started trading smart at a discount. We very rarely discount Smart so act quickly. Also both the Four Step Method and the Signal To Signal method are available again as automated trading systems. These are only available for a limited number and time. Check the order page for more information.

If you have any questions about basket trading using volume or any questions at all please send a ticket using the support link.

The post Basket Trading Using Smart Volume Spread Analysis appeared first on Smart Trader.

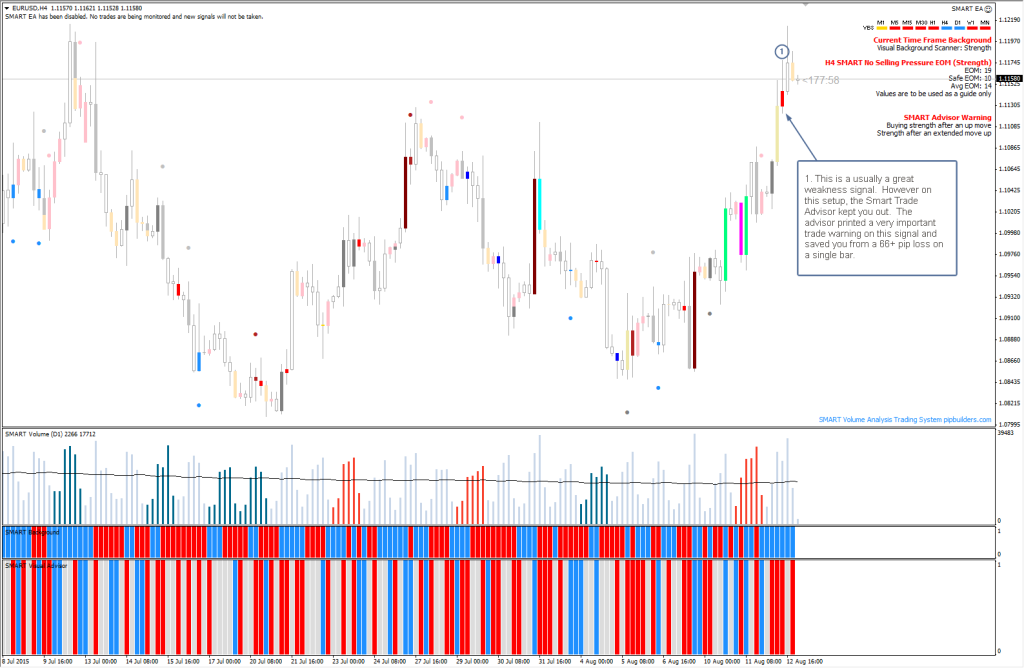

This article is going to focus on some very simple signal confirmation techniques you can use to confirm a signal that may have an advisor warning within our Smart Volume Analysis software.

This article is going to focus on some very simple signal confirmation techniques you can use to confirm a signal that may have an advisor warning within our Smart Volume Analysis software.

I hope everyone had a great year.

I hope everyone had a great year.

I wanted to take a moment to update everyone on a few things. It’s been quiet here for a few reasons namely the coming holidays and work on a number of things I cannot discuss as of yet. For those of you that are waiting on the release of the signal to signal automated trading system, it’s taking slightly longer to get it released because of a recent update by Metatrader which has caused some issues. I thank you for your patience. We are actually only slightly behind schedule so that’s a plus. We have a lot of announcements coming shortly in terms of Smart and it’s future which brings me to a testimonial. A client named Mike is about to go full time trading thanks to Smart and was concerned because of our licensing that he may be left high and dry if we ever decide to shut down. I get this question from time to time and want you to know that as a client, you are protected. Even if I die Smart would resume for any valid license holders. I have pasted the complete unedited ticket from Mike below. I only removed his last name for privacy.

I wanted to take a moment to update everyone on a few things. It’s been quiet here for a few reasons namely the coming holidays and work on a number of things I cannot discuss as of yet. For those of you that are waiting on the release of the signal to signal automated trading system, it’s taking slightly longer to get it released because of a recent update by Metatrader which has caused some issues. I thank you for your patience. We are actually only slightly behind schedule so that’s a plus. We have a lot of announcements coming shortly in terms of Smart and it’s future which brings me to a testimonial. A client named Mike is about to go full time trading thanks to Smart and was concerned because of our licensing that he may be left high and dry if we ever decide to shut down. I get this question from time to time and want you to know that as a client, you are protected. Even if I die Smart would resume for any valid license holders. I have pasted the complete unedited ticket from Mike below. I only removed his last name for privacy.

Our Smart Trader Volume Spread Analysis Software Has Been Helping People Trade Smarter For 5 years!

Our Smart Trader Volume Spread Analysis Software Has Been Helping People Trade Smarter For 5 years!