Pattern Trading is the basis for most traders systems but patterns themselves are not enough to form a winning trading method. If they were, everyone that could recognize a simple pattern would be insanely wealthy. So, what is the missing piece of the puzzle that most traders fail to learn about and focus on? The answer is volume, and more specifically smart volume analysis. Smart Volume Analysis gives us the ability to see and profit from the hidden meaning within these patterns day in and day out with very little effort.

As an example, we’ll use one common pattern that when combined with volume becomes one of ours to demonstrate why volume analysis is the missing element in your trading. The pin bar is a very popular pattern to trade. A pin bar typically signifies a reversal in the market. However, a pin bar by itself is fairly meaningless as they occur all over the place. When they work, they’re certainly very powerful but trading these without any other meaningful verification will very quickly deplete a trading account.

Some people will say “but they do work most of the time”. This is simply not true and a hard pill to swallow if you trade them but you can show me five times where this or any pattern for that matter “worked” and I can show you ten times where they failed. So what’s missing? How do you, or anyone know if a pattern is valid and worth trading? The answer is simple… Volume. Volume is the only real time analysis tool that will show you what is actually happening within the market at any given moment. Just like patterns, volume too is not always enough as you will soon learn… To make it as a trader you need a comprehensive tool set capable of displaying signals and their meanings in a concise, easy to read manner right on your chart. You also need a guiding hand from someone who knows why traders and more importantly trades, fail time and time again, and how to avoid many common trading mistakes without having to get a degree in rocket science.

“Volume is the only real time analysis tool that will show you what is really happening within the market at any given moment.”

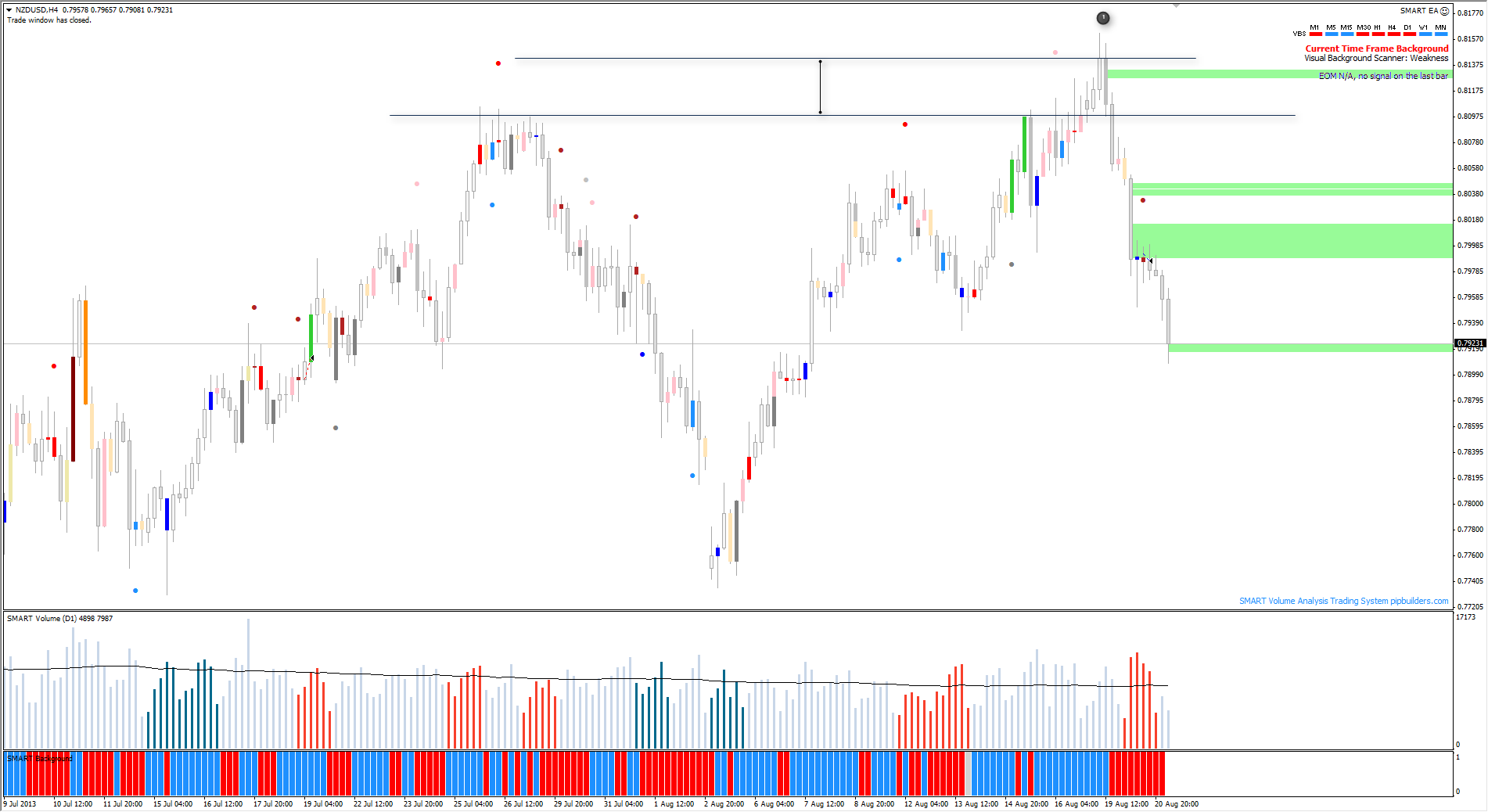

Take a look at this example chart taken in real time after a specific Smart Volume Analysis Signal. (Please open this chart in a new tab/window and follow along with the text below):

Please note that example #1 on the chart is a typical pin bar and that it is also a valid Smart Upthrust which is printed as a blue bar in our Smart Volume Analysis Trading Software. This would normally be an excellent place to open a long position as it is a strength signal and one of the best of our so called “catalyst” signals. A catalyst signal is simply a Smart Volume Signal that typically precedes a very large movement in price.

If you saw this pattern and you normally trade pin bars you might have taken this trade. If you only trade smart catalyst signals, you may also have taken this trade as well but notice point #2 on the example chart… These are the various warnings that our software printed for this particular signal based on it location in the range and other factors. Had you avoided this trade based on our Smart Advisor Warnings, you would have saved yourself from a loss of nearly 20 pips, possibly more as the bar had still not closed when the screenshot was taken. Now look at example #3 on the chart. See the huge move? This is quite a different story from example #1. This is the same chart, same timeframe and the exact same signal as example #1 but with one key distinction… There were no Smart Volume Analysis warnings on this trade. This trade ended up being a 100+ pip winning trade had you taken it. This is the true power of smart volume analysis and clearly shows how adept our advisor module is at keeping you away from potentially losing trades.

Smart Volume Analysis shows you very quickly and effortlessly which patterns are valid, what their profit targets are thanks to our proprietary EOM concepts and module and the software even warns of potential dangers based on our research observable rules within the advisor module as shown in the above examples. That said I would add that while your percentage of winning trades will no doubt be much higher once applying our concepts and methods, we recognized that certain patterns needed additional scrutiny before a trade could be placed. In our own trading and the development of Smart Volume Analysis, we found time and time again even though the win rate was very high for our valid signals, there were times that they didn’t work. A pattern emerged and I was interested in identifying and cataloging these conditions so that I could avoid trades that would likely fail. Much of my initial research lead to our Dead Zone concept which improved our trading quite a bit on it’s own but that wasn’t enough. I found certain signals in a certain spot would almost never work no matter how good the signal was. These observations became the basis for what I trained many clients to look out for in the free live rooms but it’s difficult to remember these guidelines when following multiple charts. Many signals had different guidelines and we needed a way to easily report these right on the chart and in real time. This is why our Smart Advisor Module was created. Every Smart Volume Analysis signal that appears is analysed instantly by Smart and the output if needed is available instantaneously on your chart based on our observations for that particular pattern (See example #2) . If there are no warnings, the trade is deemed safe and has a very high chance of working as expected and in hitting it’s EOM (Profit Target Levels).

As you would imagine, some warnings are stronger than others. Each warning and it’s meaning is detailed within the documentation site so that you can familiarize yourself with them and begin applying these guidelines to improve your trading in a very short time

For more information or if you have any questions about SMART Volume Analysis (SVA) and Smart Volume Spread Analysis (VSA) the methods, or our Software (Smart Trader) please visit the following link

Usergroups:

- Smart Traders Official Google+ Community (Recommended): http://goo.gl/7X6UD

- Smart Traders Official Google+ Page: http://goo.gl/B0Eph

- Smart Traders Official Facebook Group (Closed To New Members): http://goo.gl/8vH1t

- Smart Volume Analysis Blog: http://goo.gl/wHdCU (News, Information, Trading Methods Etc.)

Miscellaneous Resources:

- Smart Volume Analysis Video Newletter: http://goo.gl/zoUDd

- Free Live Room (Usually Runs Each Day): http://goo.gl/2bKP9 (Check usergroups for start times)

Contact and Support Links:

![number-3-md[1]](http://blog.pipbuilders.com/wp-content/uploads/2013/04/number-3-md1.png)