If you’ve read any of the articles about Smart Volume Analysis you know I normally suggest taking quick Catalyst trades to our one bar EOM Targets as shown in the screenshot to the right however, the aim of this article is to show just how easily you can consistently trade larger moves with just a few simple steps. This article was inspired by a recurring conversation I have with many traders on trend trading. Enjoy.

Why is Trend Trading Like Chasing Ghosts?

I hear a lot of people say I trade trends. Trend trading is one of the most damaging myths in the trading world. I liken it to “Chasing Ghosts” The trend is your friend? Yeah… Sure it is. That quote gets bandied about a bit but the problem is most people don’t usually hear the full quote. The complete quote is ‘The trend is your friend… until it ends.’ It paints a different picture when you hear the end of the quote included doesn’t it?

It’s not that trend trading is a bad thing or that you will always fail but rather that trends are very difficult to trade correctly and consistently and stay profitable over the long haul. Unfortunately many traders lose a lot of their capital trying to catch these waves and eventually give up in disgust.

Trying to catch a trend? You are chasing ghosts and you will likely lose a lot of money while you hunt.

How could you possibly know when a trend is ending? Many times traders enter long on a nice up move and get creamed in short order. They scream “but the trend was up!” Don’t get me wrong, trends (large moves up or down on longer time frames) do exist and are great trades when you get in them however they are notoriously hard to identify and trade correctly. Even with so-called trend trading software and tools you will likely fail more than you should.

The trend may be your friend but Smart will always invite you to the best parties.

So what is the secret to successful trend trading? How can you know when the trend is going to end? If you could figure that out you’d be very wealthy and probably wouldn’t need this article…

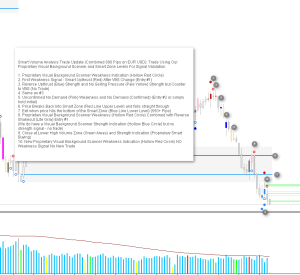

It is not only possible, it’s very easy to get in early on a large move in price and ride it all the way to the next major reversal and take it back the other way. We prove it again and again in our articles and it’s actually very easy to do. When you trade using Smart Volume Analysis, you can clearly see where these large moves start and turn around. They are often preceded by what I call Catalyst Signals. All signals are clearly marked on the chart and when a catalyst signal appears, we know that the start of a large price move is about to begin. We can enter the trade with confidence and ride the complete move, then exit safely on the next catalyst signal and if conditions are right, take the trade in the opposite direction for another large move the other way. You can do this day in and day out. Take a look at the following screenshot. I marked the longer moves and noted the signals that preceded them. Do you see the repeating patterns? Each of the colored bars on the chart is a Smart Volume Spread Analysis signal but a few are a very special brand of signal that we call catalyst signals. These are the signals you want to trade… When you see them set up in real-time, you are always in a prime position to consistently get in, and stay in these larger price moves.

Text from screenshot:

This is how simple Volume Based Trend Trading can be: Long Term Catalyst Trades (Signal To Signal Validated by Trade Advisor)

Occasionally you get a great exit and reversal signal at the same time but usually you get out shortly before the reversal. I noted the exit signals if exited before the next entry signal. To be clear… We are only taking Catalyst Signals with Trade Advisor Validation. This should be clear to anyone that uses Smart and Trades the Catalyst Signals but for those that don’t I have marked whether the trade is taken to the next signal or if exited at a Reverse Catalyst Signal.

- 1 to 2. 546 Pips

- 2 to 3. 879 Pips

- 3 (Exit at RUT). 1012 Pips

- 4 to 5. 1071 Pips

- 5 (Exit at SS). 694 Pips

- 6 (Exit at SB Warning). 149 Pips (Only trade with DD for more than one bar)

- 7 to 8. 317 Pips

- 8 (Exit at RSO). 155 Pips

- 9 (Exit at RUT). 916 Pips

- 10 to 11. 1536 Pips

- 11 to ?. 406 Pips (? Trade is still open)

Total pips from all trades is an astounding 7,681 Pips From Only One Chart

It should be noted… Trade Catalyst Signals work on any time frame and any market. I used this chart specifically to illustrate how safely trades can be taken for longer term moves providing you enter on a Catalyst with the Smart Trade Advisor validation. It couldn’t be easier because everything you need appears on your chart in real time.

More articles and information on our software is available at our website. SmartVSA.com

Stop chasing ghosts and start trading Smart.

The post Trend Trading is Like Chasing Ghosts appeared first on Smart Trader.

Traderelayer Results update and some information/updates posted to the news section of the site:

Traderelayer Results update and some information/updates posted to the news section of the site: ![space_shuttle_launch[1]](http://dev.smartvsa.com/wp-content/uploads/space_shuttle_launch1.jpg)

results for Traderelayer and wanted to answer some of the more common questions I have receive regarding the new subscription option:

results for Traderelayer and wanted to answer some of the more common questions I have receive regarding the new subscription option: